Congress is opting for a modest measure that would extend a slew of popular tax breaks for just a few more weeks.

Congress abandoned efforts Tuesday to craft an ambitious tax plan that would have raised hopes for bipartisan collaboration when Republicans take over in January, opting for a modest measure that would extend a slew of popular tax breaks for just a few more weeks.

The development offered a stark reminder that, despite pledges from President Obama and GOP leaders to work together in a reshaped Washington, the same old political divisions hang over the Capitol — and could be complicated by fresh tensions between moderates and liberals in the bruised Democratic Party.

Under the proposal, set for a vote Wednesday in the House, millions of businesses and individual taxpayers would be able to claim long-standing deductions and credits worth $45 billion on their 2014 tax returns. But those perks would expire again Dec. 31, leaving lawmakers to squabble afresh over the matter in the new year.

That outcome favors no one. Democrats would lose a chance to expand favored tax breaks before ceding control of the Senate, and Republicans would have to revisit an issue they had hoped to settle before taking charge.

Business leaders, who have been lobbying aggressively to revive and expand a credit for research and development, among other provisions, rolled their eyes Tuesday.

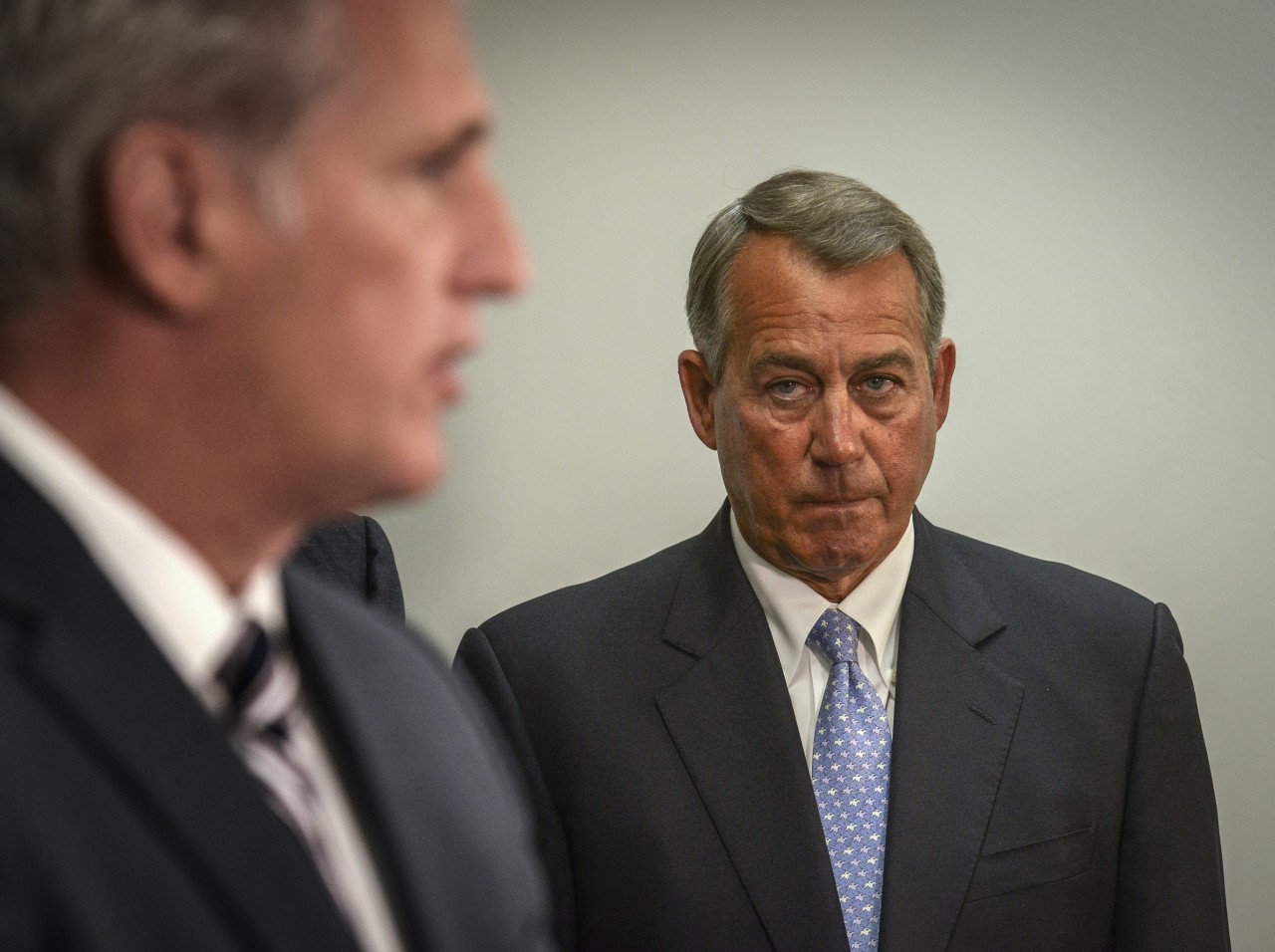

Speaker of the House Rep. John Boehner (R-Ohio.), right, listens as Majority Leader Kevin McCarthy (R-Calif.) makes remarks after a meeting on upcoming spending legislation, on Dec. 02, 2014 in Washington, D. C.

“It seems unworthy of the world’s greatest economy to have a tax code for two weeks and in January it all expires again,” said John Engler, president of the Business Roundtable, which represents the chief executives of some of the nation’s largest corporations.

Still, many lawmakers in both parties appeared resigned to that outcome, calling it preferable to the abrupt tax hike that would hit if Congress failed to act. In a meeting with House Democrats, Treasury Secretary Jack Lew signaled that the White House, too, was “open” to the short-term measure, complaining that the more ambitious package would give away too much to corporations while neglecting the working poor.

“Any deal that permanently extends business tax credits must also ensure the benefits are broadly shared by providing critical tax benefits for middle class families,” Lew told the group, according to a written statement from Treasury Department officials. “In the absence of such a deal, Secretary Lew indicated the Administration is open to supporting shorter-term alternatives.”

At issue is a package of more than 50 temporary tax breaks that benefit a wide range of special interests, including NASCAR racetrack owners, Puerto Rican rum-makers, college students and commuters. House Ways and Means Committee Chairman Dave Camp (R-Mich.), who is retiring in January, has long insisted that the best of the breaks should be made permanent, including the research credit, and the rest allowed to expire as a first step toward far-reaching tax reform.

Senate Finance Committee Chairman Ron Wyden (D-Ore.) has pushed to extend the entire package for two years. But after the election, he entered talks with Camp aimed at finding a middle ground that would incorporate two White House priorities: making permanent expanded tax breaks that benefit the working poor and those that help poor families with children.

GOP tax aides say Camp was willing to consider those provisions in exchange for additional benefits for business, including a permanent extension of a perk that lets businesses write off 50 percent of a purchase in the first year. But those talks stalled after Obama took action to protect millions of undocumented immigrants from deportation, raising fears among Republicans that the expanded benefits for poor families would wind up funneling billions of dollars to taxpaying immigrants who are in the country illegally, according to aides in both parties.

At that point, Senate Majority Leader Harry M. Reid (D-Nev.) took over the talks with Camp in hopes of salvaging a significant agreement. By last week, they were putting the finishing touches on a vast package worth more than $400 billion over the next decade. It would have made permanent several policies that have long been favored by both parties, including the research credit and the American Opportunity Tax Credit, which provides $2,500 a year toward college tuition.

But with the value of the package tilted heavily toward business — and the provisions for poor families omitted — the White House abruptly threatened to veto the emerging agreement, backed by Wyden and other liberals.

This week, House Republicans responded with their short-term extension, repaying Wyden with a “drafting error” that dropped one of his favored tax breaks — for the purchase of electric motorcycles — from the bill.

Meanwhile, House Speaker John A. Boehner (R-Ohio) pronounced the broader talks dead. “The president killed it. Period,” Boehner told reporters.

Wyden said he would continue to press for a two-year deal that would extend the breaks through the end of next year. Otherwise, he said, with Republicans in charge, “big business will be well positioned to present their case, while [students], veterans and working families are going to find it a challenge.”

But Reid gave no assurances Tuesday, saying only that he would “make a decision” after the House acts.