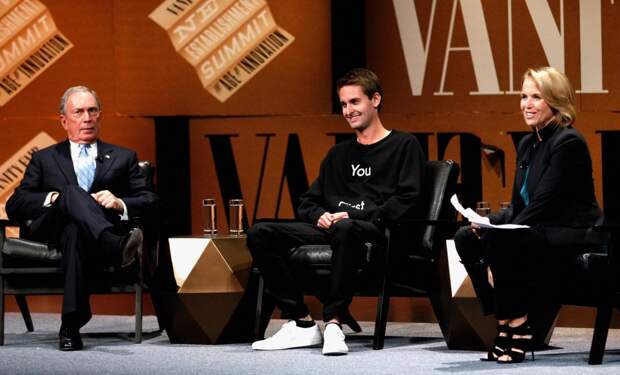

Bloomberg Founder Michael Bloomberg, Snapchat Co-Founder and CEO Evan Spiegel, and Yahoo News Global Anchor Katie Couric speak onstage during "Disrupting Information and Communication" at the Vanity Fair New Establishment Summit on Oct. 8 in San Francisco.

Twenty years ago, when investor Marc Andreessen was trying to build interest in Netscape, the first mass Web browser, he’d hook up his computer to a high-speed connection and show that it wouldn’t just let users access the Internet, it would let them watch television.

“We’d show how you could watch ‘Melrose Place,’ ” he said.For Andreessen it was proof positive even then that the Internet wouldn’t only turn the world of technology upside-down. It would disrupt the entire media industry.

It was also the beginning of what would be one of the nastiest rifts in American business: Engineers all over Silicon Valley thought the technology to turn your PC into a TV was cool. Media executives in New York and Hollywood were horrified. How would they be paid for their content if the tech industry digitized it all and made it easy to steal? They tried to cut deals that would head off this threat. The problem was that most of those deals — notably AOL’s purchase of Time Warner — turned out to be disasters. Meanwhile, Silicon Valley kept coming up with better, faster, smarter gizmos that millions of people wanted to use.

By the end of the 1990s, executives were screaming at each other in public over the file-sharing site Napster. Silicon Valley accused New York and Hollywood of being anti-innovation and anti-consumer. Media executives described high-tech executives as criminals — accessories to theft of their property.

Today, Andreessen is richly rewarded for his prescience.

He is one of the top venture capitalists in the Valley, his success rooted in an early vision of how the worlds of high tech and media would evolve. He was among the first investors in Twitter and Facebook. He drove the sale of Skype to Microsoft, and he along with partner Ben Horowitz, have backed a host of new media startups like Oculus, the virtual reality outfit recently sold to Facebook for $2 billion.Andreessen’s rationale is simple: The explosion of smartphones and tablets — 2 billion now and expected to reach 5 billion soon — is making television portable, and even more ubiquitous than it already is. As such, the distinction between a television, a smartphone, a laptop computer and a tablet are becoming meaningless. They are all just screens connected to the Internet. Television programming and computer programming used to mean different things. Increasingly they are the same.

As he sees it, software, like steel and plastics in the 20th century, has become the raw material of all progress.

It’s no exaggeration to say that high tech and media are just beginning their love fest. YouTube stars like PewDiePie, Smosh and the Fine Brothers are aggressively courted by big-time Hollywood agents. Startup executives like Jack Dorsey of Square and Twitter, are joining the boards of old-line media companies like Disney.

Media titans like Michael Lynton, the head of Sony’s worldwide entertainment business, are joining the boards of startups like Snapchat. Tech companies like Netflix are making their own shows and giving old media enterprises like HBO, a run for subscribers. Amazon has created a studio to make its own content.

And even old media executives like Robert Iger, Disney’s chief executive, says it’s only a matter of time before consumers can buy their video entertainment, including ESPN, a la carte. The death of the cable bundle is inevitable.

“I see a future where the consumer decides instead of the distributor what gets bundled and what they purchase a la carte,” Iger said last week.

Nowhere was this love fest more on display than last week in San Francisco. Vanity Fair — better known for its marquee reporting, its fawning coverage of movie stars and its glitzy Oscar parties — hosted its first technology conference. For two days nearly 800 attendees — mostly from New York and Hollywood — were treated to a slew of panels highlighting the vast changes both industries face. The scene? The auditorium in the Yerba Buena Center for the Arts, where the late Steve Jobs unveiled the first iPad and other Apple products.

The mashups were fascinating and at moments most unexpected. Evan Spiegel, the 24-year-old founder of Snapchat, shared the stage with Michael R. Bloomberg and Katie Couric. Bloomberg wore a suit. Couric was in fitted black pants and three-inch heels. Spiegel, looking like their kid — grandkid even — just out of the college dorm, was in a sweatshirt, jeans and crisp white sneakers. Bloomberg, who has been something of a mentor to Spiegel, couldn’t help pointing out that Spiegel “is exactly a third my age.”

But the conference was also seminal, too. Vanity Fair has touted its so-called New Establishment for a while. But with its arrival in San Francisco, Silicon Valley emerges as the new media capital of the world — shaping commerce and culture both. And at the center of that? Andreessen who was perfectly cast on a lunch panel with Mike Judge, the creator of the hit HBO series “Silicon Valley.”

“There is more music than ever, but it’s not driving the culture as much anymore. It’s been replaced by tech,” said Tom Freston, who helped create and run MTV in the 1980s and ’90s and was CEO of Viacom until 2006. “We used to wait around for the next ‘Sgt. Pepper’ [Beatles] album. Now we wait for the new iPhone.”

The iPhone is at the root of all these changes. Its unveiling in 2007 set in motion the mobile device and software revolution. Today, that drives enormous changes in how content is consumed and, more importantly, in who distributes it. The future of cable television, broadcast television, movies, music and publishing — industries that together total about $250 billion in annual revenue — are all up for grabs.

It’s hard to overstate the breadth and depth of change. In 2006, content distribution was still in the hands of theatres, DVD retailers and the cable and broadcast networks. Now, the DVD business is dying, the best directing and acting talent are abandoning movie work for a shot at a television series, and tech companies like Netflix are making executives at old-line media companies like HBO wonder if one day they’ll need to change the way they do business. Most importantly, companies like Apple and Google — who control the endpoints of our mobile devices with Android phones, the iPhone and the iPad the way Comcast controls our cable TV — are newly ascendant as potential distributors. With their hundreds of billions of dollars in cash, it’s hard to see how they won’t soon become important financial backers, too.

You Tube (owned by Google) is a particularly powerful player. The cable and broadcast networks troll it for popular shows like “Burning Love” and “Web Therapy” that can benefit from their marketing and capital. And they air portions of some shows on YouTube first as a way of building audience among teens and viewers in their 20s. YouTube is now the place teens go to discover new music and artists — the way MTV was in the 1980s.

And yet, during a Vanity Fair conference panel Susan Wojcicki, the head of YouTube at Google, was asked how she felt about still being in the minor leagues of the entertainment business — that despite YouTube’s success, it was no match for the money and prestige of a big media company when a YouTube star hit it big.

Many of those stars not only make as much as they would with big media backing, they are, according to a recent study by Variety, better known among their teenage fans. Wojcicki responded to the question from Mellody Hobson, chairman of DreamWorks Animation and president of Ariel Investments, diplomatically, pointing out that Google has worked aggressively with super successful YouTube artists to better promote and finance them. What she didn’t say, but is true, is that the top artists on YouTube already make millions and openly wonder whether they will ever need another platform. Perhaps the talent might soon start flowing the other way — from broadcast and cable to YouTube.

At this point the only thing that might derail this new media-old media love fest is a downturn in Silicon Valley. It’s due. The last big crash was the collapse of the Internet bubble nearly 15 years ago. And many of the signs that were there then are reappearing.

Few think this crash will be as bad as the last one. The bubble of 2000 was unique in that dozens of companies went public, leaving average investors hugely exposed to losses. Most of the money at stake in this bubble is that of professional investors and venture capitalists. Most important, there was little in the way of earnings and revenue holding up stock prices back then. Today, not only are companies like Apple, Google, Facebook, LinkedIn, Twitter, Amazon, Microsoft and Yahoo real businesses, so too are smaller companies like Evernote, Dropbox and Uber.

Still, the mobile app business is exploding with both Google’s and Apple’s app stores listing roughly 1.3 million titles each. Real estate prices in San Francisco top $1,300 a square foot in some areas. And, most notably, respected venture capitalists like Bill Gurley of Benchmark, Fred Wilson of Union Square Partners and Andreessen himself have started publicly wringing their hands about the excesses they are seeing. At the end of September, Andreessen took to Twitter: “When the market turns, and it will turn, we will find out who has been swimming without trunks on: many high burn rate cos will VAPORIZE.”

So much has permanently changed in how old and new media do business, however, that a downturn might push the two camps together. People aren’t going to stop watching TV and movies on their phones and tablets, and wherever those eyeballs are, expect the dealmakers in Hollywood and New York to follow.