Five years is the average length of an economic expansion in the U.S. since World War II. The one we’re in now began in July 2009—just over five years ago. That fact alone suggests that the U.S. is about to roll over into another recession. “The September 2014 recession?” is the headline on a blog post this week by Antonio Fatas, an economist at Insead business school and Georgetown University’s McDonough School of Business.

(To be sure, Fatas isn’t actually saying that will happen.)Today Goldman Sachs (GS) published a client note by economist Kris Dawsey called “Don’t Call the Expansion Old.” It argues that rather that being in its late stage, the expansion is “early- to mid-cycle.” Dawsey writes that “expansions do not die of old age” but rather are killed, and there are no expansion-killers in view. There’s no inflationary overheating, so the Federal Reserve doesn’t need to jack up interest rates to cool off growth, which can sometimes precipitate a recession. And there are no severe financial imbalances, such as the housing bubble and household overborrowing that killed the last expansion, he writes.

The Goldman paper’s main contribution is to break down the phases of the business cycle using a data-mining technique called k-means clustering that spots patterns in vast quantities of raw information. It takes 15 factors, ranging from the volatility of stock prices to the number of unemployed people per job opening and looks at how they have performed in the past. It finds their ups and downs tend to cluster together into four phases, which Dawsey labels recession, early cycle, mid-cycle, and late cycle.

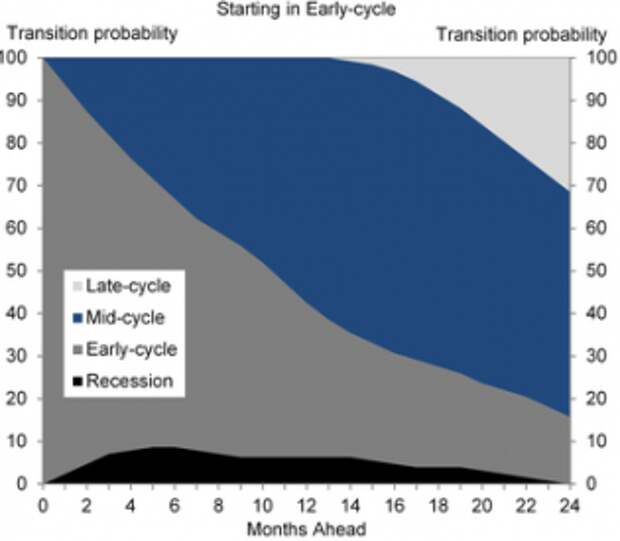

This chart shows what typically happens to an economy that’s in the early cycle of an expansion. At the starting point, when “months ahead” is zero, the graph is gray from top to bottom, meaning that there is a 100 percent chance of being in the early cycle. Within six months, there is about a 70 percent chance it will still be in the early cycle, a 20 percent chance it will be in a mid-cycle, a roughly 10 percent chance it will be in recession, and close to zero chance it will be in a late cycle.

A couple of indicators are flashing red. Credit spreads are compressed, which means that investors may be overly optimistic about the ability of less creditworthy companies to pay their debts. And the number of unemployed people per job opening has fallen to a post-crisis low of 2, which could indicate bottlenecks in the job market. On the whole, though, Dawsey characterizes the expansion as still being in its early cycle, with a likelihood of moving into the mid-cycle sometime in the next year. Still, he cautions that the historical patterns “should be viewed with some degree of skepticism in light of the unusual nature of the current recovery.”