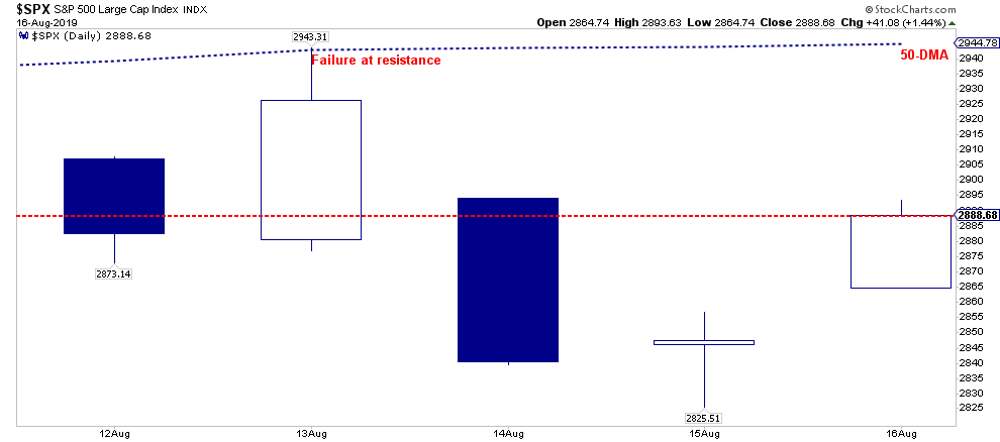

OTEUM EXPERT CALL: SP500 Intraweek Pre-FED Bounce?

OTEUM EXPERT CALL: SP500 Intraweek Pre-FED Bounce?

E-mini S&P 500 Futures (Mar 2025) CME_MINI:ESH2025

Karel_OTEUM

Here comes the pre-FED volatility—price is dipping into that “value area” and OTEUM is looking to ride it higher . But watch out: Trump is back on tweet mode , which

...Далее